Buy And Sell In Forex

Singapore is one of the Forex trading hot spots on the planet. I live in Chicago in the Usa but also spend time in Singapore. When I am with Singapore traders, I notice some of them are trying to make so many unlike strategies piece of work in the Forex market place yet none are achieving the success they are in search of. They don't realize the key factor in trading is proper marketplace timing: the ability to place marketplace turning points in advance, before they happen. It is likewise the ability to place where market prices are going to go, before they get at that place. The primary reason you would want to know how to fourth dimension the market's turning points in advance is to attain the lowest risk, highest reward, and highest probability entry into a position in the marketplace. Retrieve about it, by entering as close to the plough in cost as possible, you enjoy 3 key factors:

1) Low Take chances: Inbound at or close to the plow in cost means you lot are inbound a position in the market very shut to your protective end. This allows for maximum position size while not risking more than than you are willing to lose. The farther you enter the market abroad from the turn in price, the more than you will have to reduce position size to keep risk in line.

2) Loftier Advantage (profit margin): Similar to number 1 above, the closer your entry is to the turn in price, the greater your profit margin. The further you enter into the marketplace from the plough in toll, the more y'all are reducing your profit.

3) High Probability: Proper market timing means knowing where banks and institutions are buying and selling in a market. When you are buying where the major buy orders are in a marketplace, that means you are buying from someone who is selling where the major buy orders are in the market and that is a very novice mistake. When you lot trade with a novice, the odds of success are stacked in your favor.

Forex banking company trading strategy

And so how exercise we time the market'south turning points in advance? It all begins and ends with understanding how to properly quantify real banking company and institution supply and need in any and all markets. Once you tin do that, you are able to place where supply and demand is most out of residue and this is where toll turns. In one case price changes direction, where will it move to? Price moves to and from the significant buy (demand) and sell (supply) orders in a market. So, once more, once you know how to quantify and identify real supply and demand in a market, you can time the market place's turning points in advance, with a very high degree of accuracy.

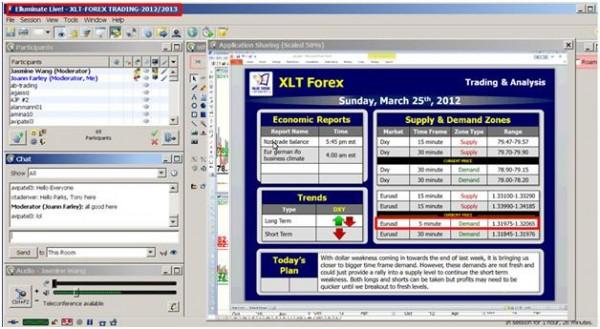

To meliorate understand how to do this, allow'southward take a expect at a recent trading opportunity that was identified in our online graduate trading plan, the Extended Learning Track (XLT) on March 25th. The XLT is a two hour alive trading session with our students three to four times a week. During the session shown beneath, nosotros identified an area of Demand in the EURO (highlighted in blood-red) / ane.31975 – 1.32065. You lot can also see that Demand zone on the nautical chart, the two lines creating a "buy zone", allowing u.s.a. to apply our simple rules for inbound a position. This was an area of Bank/Establishment Demand for a few reasons. First, notice the strong rally in price from the origin of that rally (the Demand level). Also, detect that toll rallies a significant distance earlier beginning to decline back to the Demand level. These 2 factors tell us that Demand profoundly exceeds Supply at this level. The fact that price rallies a significant distance from that level before returning dorsum to the level clearly shows us what our initial profit margin (profit zone) is.

These are two of a few "Odds Enhancers" we teach in our graduate program. They assistance u.s.a. quantify the bank and establishment Supply and Demand in a marketplace which is the primal to knowing where the meaning buy and sell orders are in a market. The programme with this trade was to buy if and when price declined back to that area of Demand. This merchandise was high probability simply how do we know that? Well, existence very confident that there is significant Demand at that level, this tells u.s. that we will be buying from a seller who is selling at a price level where Demand exceeds Supply. Selling after a pass up in price and at a cost level where Need exceeds Supply is the well-nigh novice move a trader can accept. These are "retail" sellers selling where "banks and institutions" are ownership. The retail sellers are selling with the odds stacked against them which means they are stacked in the buyer'southward favor like our XLT members in this merchandise.

Every bit you tin can see below, what happens next is price declines down to our predetermined Demand level where Banks and XLT members buy from sellers who are selling at extreme "wholesale" (Demand) prices. They are selling after that big reject in price and into that price level where Demand exceeds Supply.

Notice that price "declined" (downwardly trend) to our demand level where we were willing buyers. Every trading book would say nosotros are breaking the well-nigh important rules in trading by buying nether those circumstances. Well, how many people do you know who read trading books that brand a consistent depression risk living year later on year trading? I would exist surprised if you knew one so exist careful with what you read. The trading volume version is conventional thinking which has yous buying high and selling low then be conscientious. Don't take my discussion for it still, read a trading book and inquire yourself if how that volume is instruction you to buy and sell in markets is the same as how you make money buying and selling anything in life. If there is any difference, practiced luck trying to turn a profit from the information. Like annihilation in life, there is the volume version way of learning to do something and the real earth way. All we are doing at Online Trading Academy is simply sharing real world trading with you. We are non trying to reinvent the wheel. How you lot brand money buying and selling anything in life is exactly how y'all make money ownership and selling in markets. I learned reality based trading during my years on the trading floor of the Chicago Mercantile Exchange.

Shortly afterward reaching our demand level, offering XLT members a low risk buying opportunity in the XLT, price rallied and met the profit targets. This is market timing and while it does not guarantee that each trade will be a assisting trade, it does offering the lowest risk entry, highest advantage with that entry, and highest probability of success. How loftier your winning percent is with the strategy depends on your ability to identify cardinal bank and institution supply and demand levels like we do at Online Trading University.

I sometimes hear people say "I don't want to try to pick market tops and bottoms, I am simply trying to take hold of the eye of the move." They are tendency followers and say that as if doing that is somehow easier. If price is already moving higher for example and you lot want to buy, where do you enter, where is your protective end, what is your take a chance / reward and then on… I would argue that catching the middle of a move and making a consequent low risk living is harder than proper marketplace timing. I am not suggesting the trend is not important. I just want our students to be in the market well before the trend is underway. The longer we wait to enter, the greater the run a risk and lower the reward. Another matter I hear people say so often is this: "I wish I knew where the Banks and Institutions were buying and selling." Every time I hear this I say: "You lot can see where they are buying and selling, if you know what to look for on a cost chart." It all comes down to supply and need, just like buying and selling annihilation else in life.

Larn to Merchandise Now

Note: All information on this page is discipline to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and practice non necessarily represent the opinion of FXstreet.com or its management. Chance Disclosure: Trading strange commutation on margin carries a high level of risk, and may not be suitable for all investors. The loftier caste of leverage can work confronting y'all too as for you. Earlier deciding to invest in strange exchange y'all should carefully consider your investment objectives, level of experience, and chance ambition. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore y'all should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign commutation trading, and seek advice from an independent financial counselor if you take whatsoever doubts.

Source: https://www.fxstreet.com/education/lessons-from-the-pros-201204170000

Posted by: landrycareepard.blogspot.com

0 Response to "Buy And Sell In Forex"

Post a Comment