Trend Following Strategies Binary Options

10 best Binary Options Strategies for beginners and professionals

- x best Binary Options Strategies for beginners and professionals

- Why should yous utilise a trading strategy?

- The basics of Binary Options strategies:

- The point

- Approach 1: Post-obit the news

- Approach two: Technical analysis

- The trade amount

- Approach 1: Percentage-based

- Approach 2: Martingale

- The point

- How to tell if a Binary Options strategy is adept:

- Recommended brokers for using Binary Options strategies:

- The x all-time Binary Options strategies

- ane. Strategy – Going along with trends

- How to apply

- ii. Strategy – Following news events

- How to apply

- 3. Strategy – The Straddle Strategy

- How to apply

- 4. Strategy – The Pinocchio Strategy

- How to apply

- 5. Strategy – Candlestick Germination Patterns Strategy

- How to apply

- 6. Strategy – Fundamental Analysis

- How toapply

- seven. Strategy – The Hedging Strategy

- eight. Strategy – The Momentum Strategy

- ix. Strategy – Coin Menses Index strategy

- x. Strategy – Rainbow Pattern Strategy

- Conclusion on the Binary Options strategy

- ane. Strategy – Going along with trends

Trading Binary Options is now one of the nigh popular ways of having skin in the game. The appeal of binary options is not difficult to recognize – at start blush, the transparent options look like a great way to make money fast.

Merely like any other way of making money, trading Binary Options is non that unproblematic. Y'all must accept the fourth dimension to learn or codify and implement a solid trading strategy.

Whatsoever options trader worth their salt knows a couple of proficient trading strategies that tin make them profits and get them out of sticky trading situations.

If you oasis't learned any strategies however, don't sign upwardly for a broker and caput into the market just yet. Slow downwards and invest some fourth dimension into learning. There's plenty of time for y'all to make money with binary options.

There is no shortage of bully Binary Options strategies, either, and we've highlighted some of the best strategies for you in our guide below.

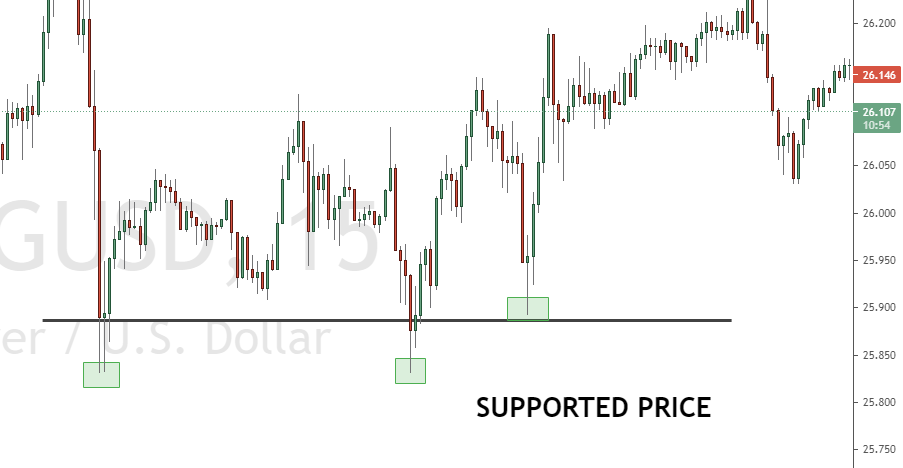

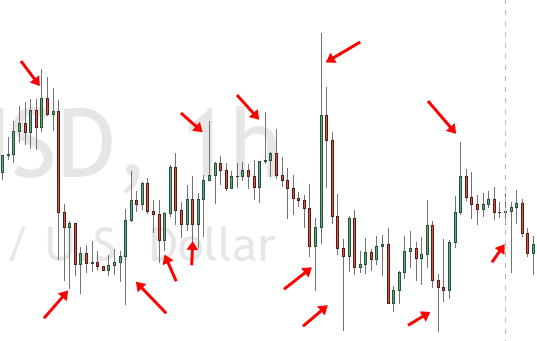

Meet an example hither:

Why should you lot use a trading strategy?

Regardless of what kind of derivative you lot're trading and what market place you lot're trading it in, approaching a trade without having a programme of activity is rash at best and unsafe at worst.

It is alike to giving someone your money without knowing what they'll do with it. Yous must have an entry and exit plan and a set budgetary goal – without these, yous're essentially relying on fate to make you lot coin.

Information technology is a traders' job to use the tools available to them and brand informed decisions. Good traders never treat a trade as a gamble.

Furthermore, using trading strategies ensures that you don't make an emotional conclusion. Greed and fear are feelings that arise when yous're putting hard-earned money on the line, and with a strategy in place, yous will never bet more than than yous can afford to lose.

If yous're trading Binary Options, it becomes even more important to use strategies. While the instrument is easy to merchandise with, you can yet lose a lot of money if you make poor decisions or bet on the wrong options.

- Find better decisions for your trades

- No emotional acting

- Using a trading programme

- No gambling

- Know when the market is moving

- Profitable in long-term trading

(Risk warning: Trading involves risks)

The nuts of Binary Options strategies:

There are two parameters yous need to know about: The signal and the merchandise amount.

The bespeak

A signal is simply an indication of whether the underlying nugget'south toll volition go up or downward. Every strategy involves either creating or recognizing a signal, which y'all must use to make up one's mind whether you lot should buy or sell an selection.

Yous can make a betoken in two ways: by technical analyses or by following the news.

Approach 1: Following the news

If you don't accept a lot of feel, you tin can follow the news and use news events as signals. Pay attention to all of the publicly available information – industry announcements and CEO decisions ofttimes accurately point whether an asset'due south price volition ascent or autumn.

Arroyo 2: Technical analysis

Trading stocks and trading options are two very different things, but the two also have some similarities. You can use technical analysis for trading both stocks and options.

To put information technology briefly, technical assay involves examining all the information relative to the asset without considering the broader market's movements.

Technical analysis is discernibly more than complicated than looking at news events – you will need to await at how an nugget'southward toll has moved in the past to predict how information technology volition move in the future.

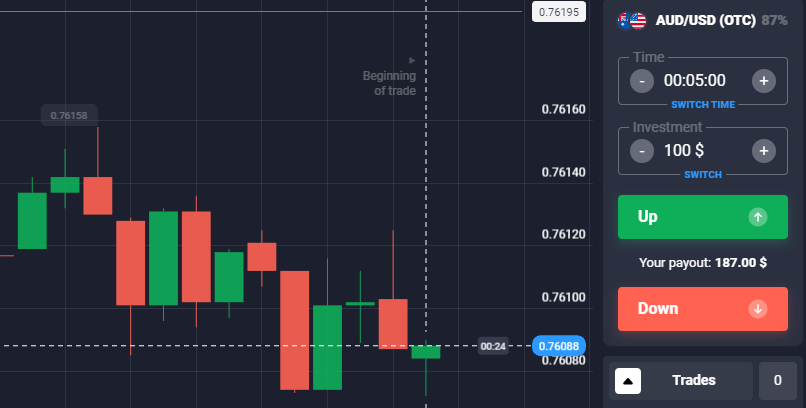

Example for a technical analysis signal:

Conducting technical analysis may seem extremely difficult to new traders, merely y'all must realize that your brain looks for patterns in things every day. All you have to exercise is larn to use charting tools and understand a few concepts before getting accepted to forming signals based on the data y'all collect.

All told, you lot must recognize what yous're more comfy with to increment your chances of making profits. Equally a beginner learning technical assay, you could benefit a whole lot by practicing strategies using dummy money with a demo business relationship.

Many brokers offer demo accounts for complimentary. Getting some practice and gaining some experience before investing existent money into the market is the right fashion to get. Until then, use news sources to make coin with binary options (more than on that below).

The trade amount

You must have an underlying coin direction strategy to determine how much you volition trade regardless of your approach.

The two about common money direction approaches traders use are the Martingale and the percentage-based approach.

Approach i: Percentage-based

Using the percentage-based arroyo to money direction is your best course of action when you lot're starting out. The method is a lot less risky since it determines how much you should invest in a trade based on how much y'all have in your account.

In this strategy, you must first reflect and come upwardly with a percentage of your capital y'all're willing to run a risk. Near traders bet one% or ii%; however, more than experienced traders may likewise choose to chance 5% of their upper-case letter.

(Risk warning: Trading involves risks)

Once yous decide how much you lot want to take a chance (we recommend 1%), you can get ahead and trade i% of your majuscule on every trade. Let'southward say you have $10,000 in your business relationship. You lot can make a $100 trade if y'all're applying this strategy.

If you lose money, the next time y'all make a trade, you will have less to invest since you will take less coin in your account.

Merely this likewise means that you lot will have money in your account at all times, and you could bet more after each successful trade. The per centum-based approach helps ensure that y'all make profits consistently.

Approach 2: Martingale

The Martingale approach will have you lot double the amount you're trading after a loss, then you can recover from the loss and so some.

Nonetheless, this approach could pb you to lose all of your money if you don't have much feel and go on a losing streak.

How to tell if a Binary Options strategy is good:

A neat binary options strategy will generate a betoken that makes you money consistently.

Learning strategies, personalizing them, and testing them out is the only way to observe a adept strategy. Whatsoever trader worth their salt will tell you that the strategy you utilize will pave the way to your eventual success (or failure).

You lot must remember that some strategies yield outstanding results in the brusque term, and others brand you bang-up money in the long term. Recognizing which strategy is suitable for what circumstance is a office of beingness a good trader.

Every time you develop a new strategy or brand changes to 1 yous use, exam it out.

Never risk real capital to exam a strategy you lot don't know works. Also, make sure y'all have a money management strategy to complement your signal.

Recommended brokers for using Binary Options strategies:

If you want to start trading Binary Options successfully, you will demand a reliable broker. In the next section, we show your 10 dissimilar strategies. We recommend using the practice account starting time before you invest real coin. The following 3 brokers a tested and checked past us:

| Banker: | Review: | Advantages: | Business relationship: |

|---|---|---|---|

| 1. IQ Option | | + Best platform | Live-business relationship from $ 10 (Risk alarm: Your capital letter can be at hazard) |

| 2. Quotex | | + New banker | Live-account from $ ten (Hazard warning: Your capital can be at take chances) |

| 3. Pocket Choice | | + Accepts any clients | Live-account from $ 50 (Take a chance warning: Your capital can be at risk) |

The x best Binary Options strategies

In the following, we show you the 10 all-time trading strategies for Binary Options:

one. Strategy – Going along with trends

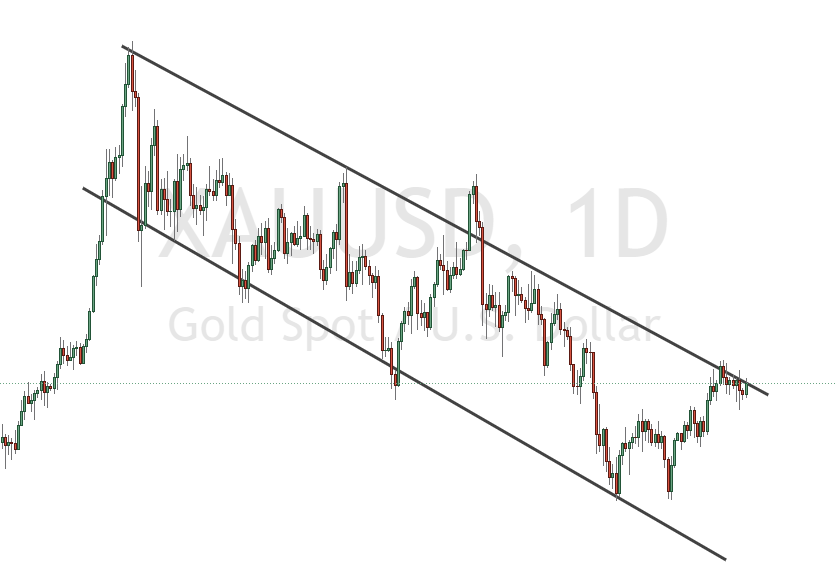

Regardless of what market you lot're in or what asset you're trading, one of the best ways to brand coin is to continue with a trend. It's arguably the best strategy a beginner can utilize.

Asset prices typically movement in accordance with trends. The cost will rise or fall along with associated assets since the market is constantly speculating and in real-time.

You must call back that a trend rarely has a straight line up or down. You will typically run across an asset's price move in a zig-zag pattern in a full general direction – upwards or down. Recognizing the blueprint allows you to estimate whether an option's cost will be higher or lower at decease.

There are two ways of trading with trends: you tin can either trade with overall trends or trade with swings.

See the example of a trend:

The safer way to go about trading with trends is to focus on the trend'southward overall direction. Most traders make a profit by looking at the general direction and setting an end-of-day or end-of-week expiry. This strategy doesn't work well with short-term trades.

Alternatively, you can merchandise with every swing in the trend. As mentioned earlier, trends typically move in a zig-zag fashion. Betting during the up or downswing can brand you more money in a short period, merely information technology is also significantly riskier.

How to use

You must examine the chart and wait at the trend lines. If the line is flat, find some other choice to trade. Even so, if you lot see that the line is going up, the cost will likely go higher. The aforementioned is truthful if you meet that the line is going down.

Once you lot find the right asset and trend, you can apply Binary Options and make money if your speculations are correct.

two. Strategy – Following news events

While post-obit the news is one of the most bones strategies, it can make you good profits. It is easier than performing technical analysis, but it requires you to read the news and stay in the loop all day, every day.

Online news is only the start. You must pick up newspapers, melody into news stations, and leverage every bit many other sources of information equally you can. The idea here is to sympathize the asset equally deeply as possible before evaluating whether its cost will rise or fall. We recommend using the "economic agenda" where are daily news and events published.

You also demand to reflect upon human being behavior. A piece of news you find positive may not exist seen every bit swell news by the residual of the market.

One of the drawbacks of using the news to make trading decisions is that you cannot tell how far upwardly or down the price will go and how long the price motility will last because of a particular outcome.

That existence said, in that location are some things you lot tin do to increase your chances of making a profit:

- Leverage the breakout: A breakout is a short window betwixt the news release and its affect on the marketplace. Information technology tin can last for a few seconds or keep for a few minutes. In this strategy, you want to bet large since there are meaning price movements after a breakout. Using loftier/low options is the correct fashion to get.

- Employ purlieus options: If you're sure that an asset's price will motility simply don't know in which direction, estimate how far upward or down the price could go, and use a boundary choice. This mode, regardless of if the news is positive or negative, you lot will brand a profit.

How to apply

One of the best ways of using the news to make a profit is to follow tech companies and find out when they're making their next declaration.

If you lot detect out they will exist unveiling a new production, you lot can buy options and wait for your profits to roll in when everyone loves the new production.

(Risk warning: Trading involves risks)

3. Strategy – The Straddle Strategy

This strategy must exist used in conjunction with the news strategy. Straddle trades must be fabricated right before an of import annunciation.

The asset's value may increase for a brusk period later an announcement, only you must buy an option estimating that the cost will come dorsum down again.

When the toll starts to drop, yous tin can call another pick expecting the price to rise once again.

The strategy leverages the swings of a trend. You will brand some money regardless of if the price goes up or down. The straddle strategy is known among traders as one of the most consistent means to make profits – even in a volatile market.

Merely deport in mind, pulling information technology off requires good analytical skills and experience in the market.

How to apply

Let's assume in that location has been a aureate mine explosion that will significantly impact the market. The price of gold volition fluctuate frantically since investors don't understand whether the price will go up or down.

In this scenario, the affected companies will scramble to find a solution to keep production.

Using the straddle strategy and leveraging the waxing and waning of the marketplace in scenarios like these is an fantabulous way to make profits using binary options. You will benefit from the market regardless of what happens in the long run.

4. Strategy – The Pinocchio Strategy

The Pinocchio strategy is similar to the straddle strategy – it calls for deliberately betting against the current trend.

In a nutshell, if an asset is experiencing an upwards trend, you must place an option expecting the price to fall. By the same token, y'all must use an pick expecting an asset's price to ascent if the asset is experiencing a downward trend.

While beginners with no cognition tin can apply the strategy, a deep agreement of the asset is essential to making this strategy work. Only if you understand how the asset works volition yous make accurate predictions and make profits.

How to utilize

You must starting time look at the candlestick chart of the asset you're looking to trade. When the candle is white or dark, it indicates that the market is bearing or bullish, respectively.

If the wick of the candle points downwards, place a call selection. If the wick points upwards, identify a put option.

(Risk warning: Trading involves risks)

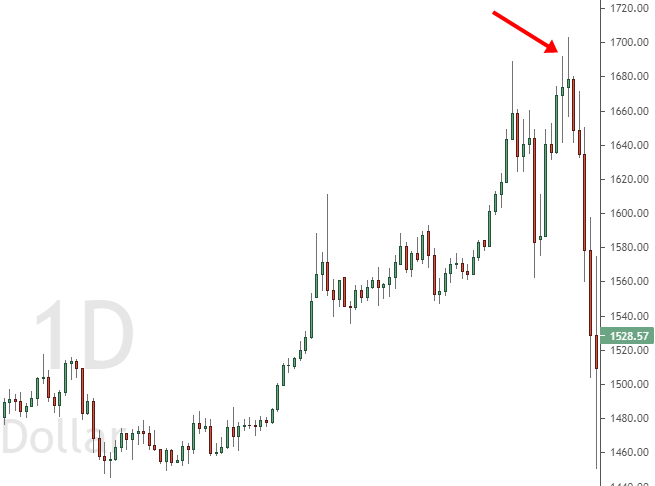

5. Strategy – Candlestick Formation Patterns Strategy

If yous know how to read asset charts, you lot can attempt out this strategy. Candlesticks show you a lot of information near how the asset behaves over fourth dimension. The candlestick'southward bottom is the lowest price it hit, and its top indicates its highest price.

You can also see the asset's opening and endmost price betwixt the peak and the bottom of the candlestick. In this strategy, you must find the asset's price over fourth dimension.

You will get-go to see formations that repeat over fourth dimension, which volition reveal the potential movement of the toll in the time to come. Typically, yous will encounter long candlesticks on the ends of the asset nautical chart ("mountains") and a collection of brusque candlesticks in between them ("valley").

How to apply

If yous see that the candlesticks of an asset are taller and the toll is experiencing a peak, you tin can expect the price to fall soon. On the other mitt, if yous see a trough of candlesticks, you can expect the toll to rise.

These mountains and valleys frequently appear over months. You lot can set death times by looking at the frequency of a mountain and valley appearing to make a turn a profit.

(Risk warning: Your majuscule can be at risk)

6. Strategy – Cardinal Analysis

Fundamental analysis is less a strategy and more than a tool to help you understand an asset better. The goal of central analysis is to gain information about the asset and so you can turn a profit from information technology later.

It requires you to perform an in-depth review of every aspect of the asset or visitor. Next, you lot must identify a depression-chance trade to see what happens, and you must trade an amount you're willing to lose.

Once the trade expires, you will know if y'all tin can brand money from the nugget and trade larger amounts.

How toapply

Allow's say you're unfamiliar with an asset, simply know that the market place is volatile and there is potential for gains.

Yous must so written report the asset and place a small trade (equally a call or put) to test out a strategy you think will work. If it works, you lot tin merchandise larger amounts in the brusque term to make profits, and if it doesn't, you don't lose much and know that you can try again.

seven. Strategy – The Hedging Strategy

Some traders consider hedging lazy, and for skilful reason. Information technology involves placing both calls and puts on the asset at the same fourth dimension.

In a way, it is similar to the straddle strategy – you will make money regardless of where the price goes.

However, y'all must summate the cost of losing to make sure you actually don't lose coin when the trades expire.

eight. Strategy – The Momentum Strategy

Using the momentum indicator is an excellent style to determine how fast the asset's price is moving upward or downwards.

Learning to use the indicator can help binary options traders judge an asset'due south cost in the future and brand profitable trades. It is as well a great method of picking the correct type of Binary Choice.

The momentum of an asset tin be analyzed in unlike ways:

- Process-oriented analysis: The momentum is analyzed by considering every period and computing the distance information technology has moved on average. Many indicators calculate this value differently, simply the most popular indicator of procedure-oriented analysis is the Average Truthful Range.

- Relative analysis: A few indicators of momentum compare the toll'southward current movement to the asset'south historical average momentum. These indicators enable you to understand if it'due south the right time to utilise a binary choice and try to brand profits. If there are strong movements in the nugget's price, you lot will be able to make super profitable trades if y'all tin manage the high run a risk. You tin also choose to trade assets with smaller movements and depression risk to brand smaller profits.

- Absolute assay: These indicators compare the electric current price to the asset'due south cost in the past while ignoring everything in between. The momentum indicator is the most pop tool for absolute analysis and compares the last period's closing price to the asset'south closing price 14 weeks ago.

You lot will encounter the consequence of these indicators' calculations every bit a pct value with the baseline being 100.

Using boundary options is ane of the all-time means to leverage the momentum and win trades. In fact, they are the only options blazon that volition allow you win a trade based only on the momentum.

Since the two target prices in boundary options are as far abroad from the electric current marketplace toll, yous don't take to worry almost the management in which the price is going.

As long as the price is moving fast enough, yous volition brand money.

(Risk warning: Trading involves risks)

9. Strategy – Money Menses Index strategy

Using the MFI indicator is i of the most effective ways to brand money using Binary Options in brusque periods. It'south ane of the best five-infinitesimal strategies out in that location.

One of the things you need to know nearly trading Binary Options is that the marketplace isn't as random in the short term. Furthermore, since your capital volition be blocked for a short fourth dimension, yous volition exist able to brand many more trades in a day.

However, all short-term strategies are based on technical analysis, including this one. This is considering no stock's cost rises or falls in the brusque-term because the company behind it is doing well or badly.

In short periods, the only thing that influences the price of assets is the supply and the demand. Technical analysis is the just style to understand if traders are buying or selling, and one of the best indicators that help you lot sympathise this human relationship is the Coin Menstruum Alphabetize (MFI) indicator.

The indicator compares the number of avails sold to the number of assets bought, generating a value between 0 and 100.

Here's how the indicator works:

- If the value is 0, all the active traders desire to sell the asset.

- If the value is 100, all the active traders want to buy the asset.

- If the value is l, the number of active traders wanting to buy and sell the asset is equal.

If you empathise the relationship between the traders that are buying and selling an asset, you can also estimate what will happen to the cost of the asset since information technology is determined by supply and demand.

If as well many traders have bought an asset, there aren't many traders left to button the toll up. The demand will become down, and the cost volition autumn.

Similarly, if as well many traders accept sold an asset, there aren't many traders to push the price downwards. The supply will exhaust, and the market place will rise.

Now that yous understand how the market works, here's how you can use the MFI indicator to your advantage:

- If the MFI is >lxxx, the nugget is overbought, and the price will likely fall soon.

- If the MFI is <twenty, the asset is oversold, and the cost will probable starting time to rise soon.

If yous discover that the MFI of an asset is >80, you can invest in a low binary option to make a profit. In dissimilarity, if the MFI of an asset is <twenty, you tin can invest in a high binary pick to make a profit.

The MFI strategy works uncommonly well in 5-minute spans. Even so, in the long run, and in periods longer than a year, the MFI remains in the extremes.

The fundamental influences take a strong effect on the nugget and volition push the toll in the same direction for years. Using this strategy to make long-term trades won't work out well for you.

x. Strategy – Rainbow Blueprint Strategy

In one case yous've spent some time studying the marketplace and take some experience, you can consider using the rainbow blueprint strategy to increase the chances of successful trading. The strategy combines simple signals to make sophisticated predictions near the price.

The rainbow pattern strategy involves using many moving averages with different periods, and each of them is identified by a unlike color (hence the proper name "rainbow pattern").

Moving averages that employ many periods don't react to price changes every bit chop-chop equally moving averages with fewer periods.

When at that place's a stiff movement, the moving averages will exist stocked from slowest to fastest in the trend direction.

The fastest-moving average will be closest to the price; the 2nd-fastest volition be the second closest, and so on.

When you see that multiple moving averages are stacked in the right way, you will know that the cost is making a strong movement in one management. This is the right time to invest.

While y'all can use equally many moving averages equally you like, nigh traders utilize iii.

If the shortest moving average is above the medium 1, which is above the longest moving average, bet on the prices rising. If the shortest average is below the medium average, which is below the longest moving average, y'all must bet on the prices falling.

While you can set the moving averages to have whatsoever number of periods, consider doubling the number of periods in each moving boilerplate.

The ratio guarantees that the averages are just different enough to create a helpful and accurate signal. Using the nigh popular values, 5, x, and 15 is the correct fashion to go if y'all're a beginner. You will run into the aforementioned opportunities that other traders do, allowing you to tune into the within knowledge the residuum of the market place has.

When your moving averages are stacked in the correct club, you can:

- Invest immediately: Most signals are created right afterwards the final moving average aligns itself the right way. While in that location is a lot of potential for profit, the take a chance is just as high.

- Wait for i catamenia: Waiting for a menstruum to see if the moving averages remain in the same club will bring nigh a lot of security.

- Look for a couple of periods: Y'all can play information technology very prophylactic and expect for 2 or more periods to confirm the signal. But go along in mind that waiting likewise long will reduce the accuracy of your signal. By that time, the market may also begin to turn the other way. If you lot practise make up one's mind to wait, make certain it'south no longer than 3 periods.

Conclusion on the Binary Options strategy

You must remember that using a strategy merely once volition not bring yous any gains. Repeated trading is the only way to figure out how well the strategy works out for you.

Jumping from idea to thought won't help – sticking to a strategy and optimizing it to your needs will almost always event in profits.

At present that yous've learned the ten best binary options strategies test them out and master them using demo accounts. Yous'll be ready to take on the market in no time!

(Risk warning: Your capital tin exist at risk)

See our like blog posts:

Last Updated on March 15, 2022 past

Trend Following Strategies Binary Options,

Source: https://www.trusted-broker-reviews.com/binary-options-strategy/

Posted by: landrycareepard.blogspot.com

(5 / 5)

(5 / 5)

(4.7 / five)

(4.7 / five)

0 Response to "Trend Following Strategies Binary Options"

Post a Comment